Bitcoin Daily Commentary –15 July 2025

Bitcoin hit a record $123K, but with spot ETF inflows surging and retail FOMO still absent, this rally looks fueled by institutional conviction, not hype, and may have room to run.

Bitcoin's price is up 0.5% over the past 24 hours, trading at $119,900 and posted its most significant weekly gain of 8.74% since early May, closing its highest ever seven-day candle at $119,310. In the early hours on Monday, BTC reached an all-time high of $123,100 on Binance.

Bitcoin's dominance is lower over the past 24 hours, falling to 63.6% from 63.8% yesterday.

Sentiment is flat over the past 24 hours with the Bitcoin Fear & Greed Index sitting at 74 and remaining in Greed territory.

With current prices around the $120,000 level, onchain data and market flows indicate the current rally could continue, especially with signs that retail FOMO is still largely absent.

A key metric highlighting market sentiment among short-term holders (STH) is the Net Asset Value (NAV) premium, which compares the market valuation of STH holdings to their average cost basis. Currently, the NAV premium sits at 16%, comfortably within the “moderate” interest zone marked by green on the chart.

This range (0%–25%) reflects a cautious optimism among short-term investors but remains far below the historically overheated 30%–35% range, where FOMO-driven purchases have typically marked local tops.

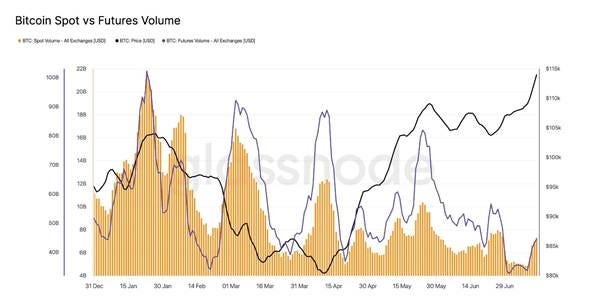

Adding to the bullish case, Glassnode underlined that Bitcoin spot volumes have jumped 50% over the past week, signaling growing participation in the rally. However, volumes still sit 23% below the year-to-date average, indicating that the broader market is not yet in full swing. Participation is rising but hasn’t hit a euphoric peak, reinforcing that this rally may still have fuel.

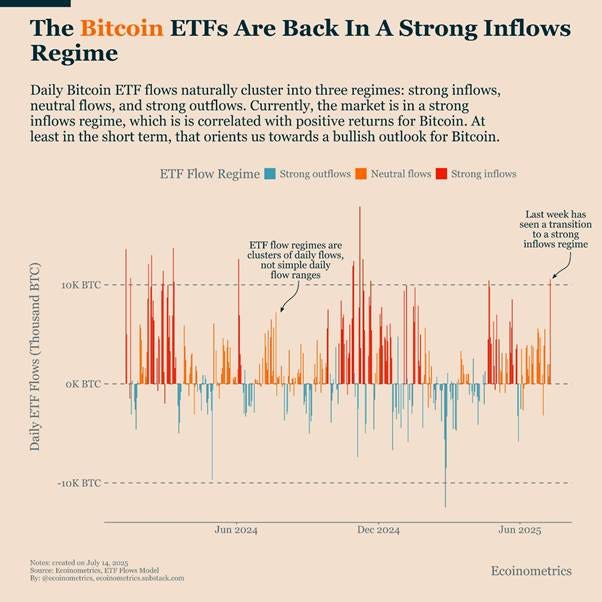

Spot Bitcoin ETFs posted its second-largest single-day inflows on record with $1.18 billion last Thursday. This surge in capital didn’t just propel BTC to its new all-time high; it also signaled a structural shift in market momentum. Historically, such shifts are not short-lived. Once strong inflows begin, they persist for multiple days or even an entire trading week, providing a firm foundation for sustained price action.

Ecoinometrics noted that the current ETF flow regime behaves as a “strong buy” signal, diverging from the previously lukewarm “neutral” status and lending additional weight to the uptrend.

The Coinbase Premium Index, which reflects the difference in BTC’s price on Coinbase versus Binance, its 14-day simple moving average (SMA-14) is currently above zero for the longest stretch in the current bull cycle, indicating prolonged buying pressure from US institutions and retail investors.

This metric was last this strong in early 2023, and its persistence suggests that US demand continues to play a critical role in supporting price discovery, even at these elevated levels.

Bitcoin is Entering a New Era — Driven Not by Retail Hype, But by the Long-Term Logic of Professional Capital.

Bitcoin has come a long way from a grassroots monetary experiment to a maturing financial asset. It took time for Wall Street to open the door to an independent disruptor, but now that Bitcoin has proven its staying power, institutions aren’t looking away. The approval of US spot Bitcoin ETFs in January 2024 marked a clear tipping point. No longer confined to crypto-native platforms, Bitcoin can now be held via brokerages, pension funds, and even insurance products.

This growing wave of institutional adoption is doing more than boosting Bitcoin price; it anchors it in our economies. Lower volatility, stronger infrastructure and easier access are allowing Bitcoin to evolve from an underground savings tool into a functional store of value, and eventually, a usable medium of exchange.

Institutional capital behaves differently from retail. While individual investors often react emotionally — selling into dips or piling in during rallies — large institutions tend to act with longer time horizons. This behavior has begun to stabilize Bitcoin’s market cycles.

Spot ETF flows reveal the shift. Since their launch in early 2024, US Bitcoin ETFs have frequently registered net inflows during price corrections, with funds like BlackRock’s IBIT absorbing capital while retail sentiment turned cautious. That said, February–March 2025 was an exception: Political uncertainty and tariff fears drove widespread outflows across asset classes, Bitcoin included. But overall, institutions are more likely to average into dips than panic-sell.

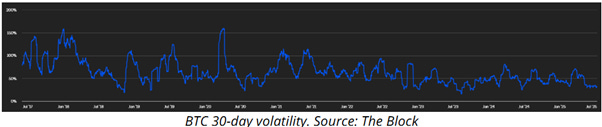

Volatility data confirms the trend: Bitcoin’s 30-day rolling volatility has dropped over the 2023–2026 cycle, likely aided by the stabilizing effect of spot BTC ETFs. While the 2019–2022 cycle saw repeated spikes above 100%, peaking as high as 158%, the current cycle has been markedly calmer. Since early 2024, volatility has hovered around 50% and recently dropped to just 35%, a level comparable to the S&P 500 (22%) and gold (16%).

Lower volatility doesn’t just soothe investor nerves; it improves Bitcoin’s viability as a medium of exchange. Merchants, payment processors and users all benefit from predictable pricing. While onchain data still shows that most Bitcoin activity is driven by storage and speculation, a more stable price could encourage broader transactional use.

Institutionalization is also accelerating adoption by making Bitcoin more accessible to the public. Retail and corporate investors who can’t or won’t self-custody BTC can now gain exposure through familiar TradFi investment products.

In 18 months, US spot Bitcoin ETFs have amassed over $143 billion in assets under management (AUM). While much of this AUM is held by retail investors, institutional participation is growing fast through investment advisers, hedge funds, pensions and other professional asset managers. As these entities begin offering Bitcoin exposure to their clients and shareholders, adoption spreads.

Ric Edelman, co-founder of Edelman Financial Engines, a $293 billion RIA (registered investment adviser) ranked No. 1 in the US by Barron’s, recently made waves with his updated crypto allocation guidance.

In what Bloomberg’s Eric Balchunas called “the most important full-throated endorsement of crypto from the TradFi world since Larry Fink,” Edelman advised conservative investors to hold at least 10% in crypto, moderate 25%, and aggressive investors up to 40%. His reasoning was simple:

“Owning crypto is no longer a speculative position; failing to do so is.”

With investment advisers currently managing over $146 trillion in AUM, according to the SEC, the potential for Bitcoin demand is enormous. Even a 10% “moderate” allocation would represent $14.6 trillion in potential inflows, a 330% increase over Bitcoin’s current market cap of $3.4 trillion. A far more conservative 1% shift would still inject over $1.4 trillion, enough to structurally reprice the market.

Pension funds, which collectively manage $34 trillion, are also slowly moving in. Pension funds in the US states of Wisconsin and Indiana have already disclosed direct investments in spot ETFs. These moves are significant: Once Bitcoin becomes a checkbox in a retirement portfolio, the psychological and procedural barriers to entry collapse.

Bitcoin’s institutionalization isn’t just a story of Wall Street buy-in. It’s a shift in Bitcoin’s role, from speculative rebel to an alternative financial system. Of course, this evolution comes with trade-offs. Concentration, custodial risk and creeping regulatory influence could compromise the very independence that gave Bitcoin its value in the first place. The same forces fueling adoption may eventually test the boundaries of Bitcoin’s decentralization.

Holding Bitcoin Isn’t Enough.

Volatility, uncertainty, and regulatory risk make it harder than ever to build wealth simply by holding Bitcoin. Even ETFs cap your upside and don’t generate income.

Some funds try to fix this with complex strategies, but they often sacrifice growth, limit compounding, or only work in bull markets. Worse, they pay out in fiat, not Bitcoin.

The Radiance Multi-Strategy Fund solves all of that.

It’s a professionally managed, income-generating Bitcoin fund that compounds with high frequency, delivers uncapped upside, and pays income directly in BTC. If you're serious about long-term Bitcoin growth, download the fact sheet now.