Bitcoin Daily Commentary - 6 March 2025

Bitcoin's price is up 3.9% over the past 24 hours, currently trading at $90,500. Meanwhile Bitcoin's dominance has risen to 60.6%, from 60.3% yesterday.

Despite Bitcoin recovering the $90,000 level, the Bitcoin Fear & Greed Index remains in Extreme Fear territory, with a reading of 20.

President Trump's tariff delay on auto parts from Canada and Mexico, along with Germany's plan to ease debt limits and China increasing its target budget deficit, led to a rise in risk markets on Wednesday and saw Bitcoin retake the key $90,000 level. Trade tensions and geopolitical risk have taken centre stage lately weighing on investor sentiment and pressuring risk assets like U.S. stocks and digital assets. Similar risk off episodes have usually led investors to flee to the U.S. dollar, translating to downside pressure on crypto assets. However, this time the U.S. dollar index has fallen to its lowest level since early November and is down more than 5% from its mid-January peak. This reflects Fed rate expectations shifting back to pricing more rate cuts than less in 2025, which would be a positive catalyst for risk assets.

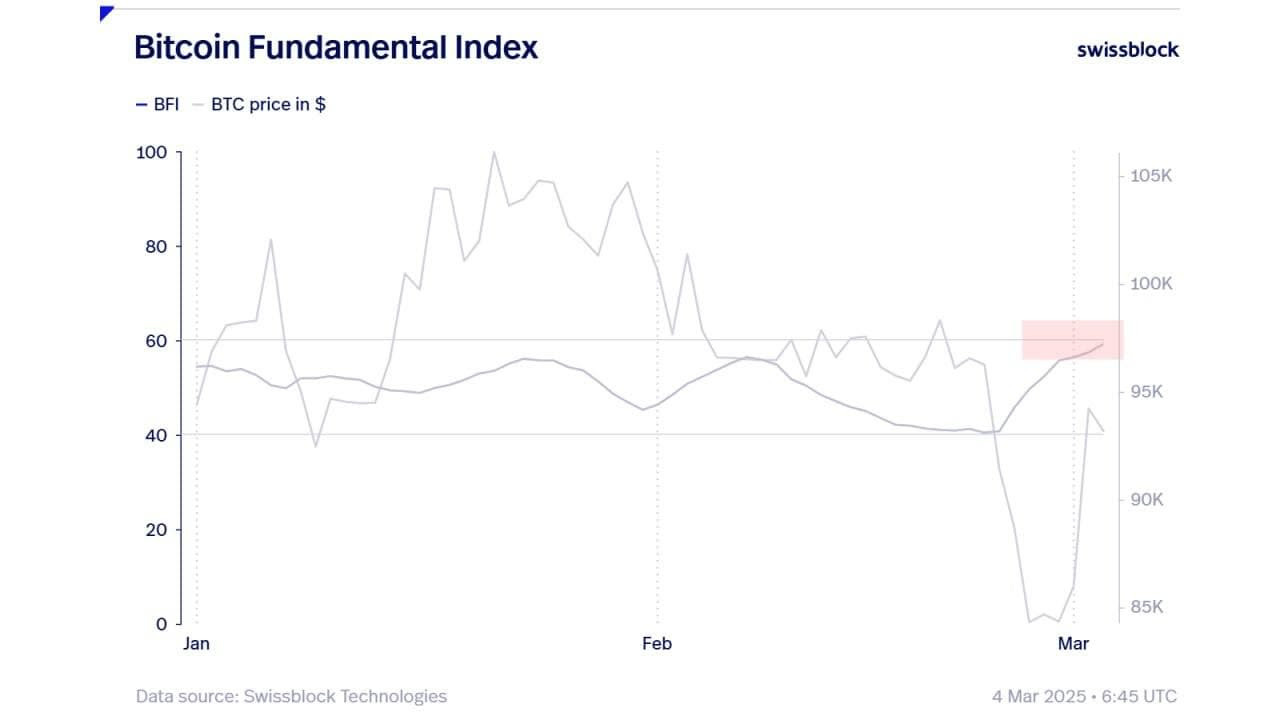

Crypto analytics firm Swissblock noted that despite the wild price swings over the past few days, the firm's Bitcoin Fundamental Index, which measures the overall health of the network, held up relatively well. They noted Bitcoin's fundamentals are on the verge of shifting into the bullish quadrant, with sustained improvements in liquidity and network growth. This strength suggests Bitcoin is unlikely to be driven into a bear market.