Bitcoin Daily Commentary – 7 July 2025

Bitcoin inches up 0.5% to $108.8K, but a record-low 0.9 Exchange Inflow/Outflow Ratio signals strong investor accumulation, hinting at a potential breakout.

Bitcoin's price is up 0.5% over the past 24 hours, trading at $108,800. Despite $1 billion in spot BTC ETF inflows last week, Bitcoin fell at the start of the weekend as the market digested a multibillion-dollar 2011-era wallet transfer, while US import tariffs are likely weighing on Bitcoin investor sentiment.

Bitcoin's dominance is lower over the past 24 hours, falling to 64.5% compared with 64.7% yesterday.

Sentiment is flat over the weekend with the Bitcoin Fear & Greed Index remaining at 73 and still in Greed territory.

The price of Bitcoin has not been particularly impressive over the weekend, which has been a somewhat consistent theme of the cryptocurrency market so far in the year 2025. The premier cryptocurrency continues to hover around the $108,000 mark, showing signs of indecision amongst the investors.

With the coin’s indecisive price action, the conversation has been about when the Bitcoin price will return to its all-time high. Interestingly, the latest on-chain data shows that investors are becoming increasingly confident in the long-term promise of the flagship cryptocurrency.

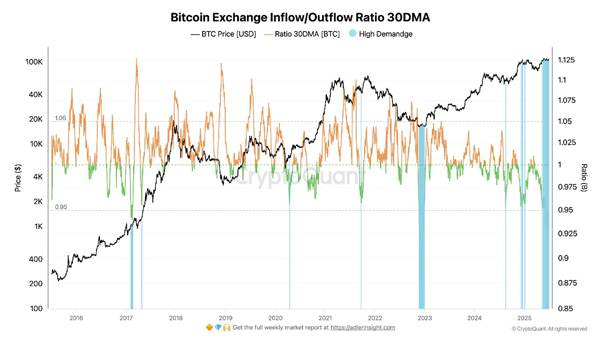

Bitcoin has continued to flow out of centralized exchanges over the past few months, and this trend reflects the growing confidence of investors in the long term. This onchain observation is based on the Bitcoin Exchange Inflow/Outflow Ratio 30DMA, a metric that measures the volume of BTC flowing in and out of centralized exchanges over a period of 30 days. A high ratio (>1) indicates more inflows than outflows into exchanges, signaling increased selling pressure for the premier cryptocurrency.

On the other hand, a low ratio (<1) implies that more coins are flowing out of rather than into centralized exchanges. When the Exchange Inflow/Outflow Ratio has a low value, it suggests that investors are accumulating and holding their coins in the long term.

The Bitcoin monthly outflow/inflow ratio recently fell to around 0.9, its lowest level since the bear market of 2023. With the metric now beneath the 1 threshold, it means that Bitcoin exchange outflows are dominant, reflecting a strong and sustained demand on the spot market.

Ultimately, the confidence being shown in Bitcoin’s long-term promise is expected, considering the growing adoption by major corporations and governments, most notably in the United States. Bitcoin is gradually evolving into a store of value, increasingly used to strengthen treasury strategies and corporate balance sheets.

As the second half of 2025 begins, Bitcoin is showing decreased volatility and logging fewer monthly transactions, as its U.S.-based spot ETFs near $50 billion in cumulative net inflows. Bitcoin's "at-the-market" implied volatility, a measure of how volatile Bitcoin is expected to trade across timespans ranging from seven days to six months, has fallen in July to its lowest levels since October, 2023, when Bitcoin traded around a third of its current value, according to data from The Block.

Alongside the decrease in volatility, monthly transactions on the Bitcoin network fell by 15% in June compared to May, The Block's data shows, logging the fewest monthly transactions since October 2023. Transaction activity has seen notable lows in recent weeks, with some abnormally low-fee transactions even being scooped up by miners looking deep in the mempool for transactions to add to blocks.

As transaction activity on the network falls, Wall Street's demand for BTC has only increased, with U.S. spot Bitcoin ETFs continually logging new cumulative inflow records. The funds logged over $1 billion in inflows over two days last week, bringing the cumulative total net inflow to just below $50 billion. The funds hold around $137.6 billion worth of BTC in total, a new all-time high, according to SoSoValue data.

Publicly-listed companies also bought BTC in June, around 65,000 BTC, worth about $7 billion at current prices, according to data from BitcoinTreasuries. A Glassnode analysis in June found that, though Bitcoin's onchain activity is a 'ghost town,' the increase in transactions from high-net-worth agents signals institutions and whales are becoming more dominant on the network.

Holding Bitcoin Isn’t Enough.

Volatility, uncertainty, and regulatory risk make it harder than ever to build wealth simply by holding Bitcoin. Even ETFs cap your upside and don’t generate income.

Some funds try to fix this with complex strategies, but they often sacrifice growth, limit compounding, or only work in bull markets. Worse, they pay out in fiat, not Bitcoin.

The Radiance Multi-Strategy Fund solves all of that.

It’s a professionally managed, income-generating Bitcoin fund that compounds with high frequency, delivers uncapped upside, and pays income directly in BTC. If you're serious about long-term Bitcoin growth, download the fact sheet now.